The trading process is divided into four key session:

Bid Session

Key features :

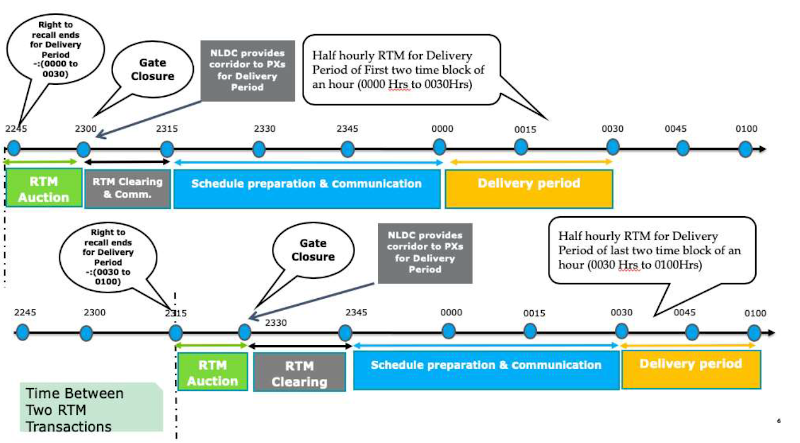

- 48 bid sessions during the day

- Each bid session for a duration of 15 minutes

- First bid session to start at 2245 hrs

- 15-minute gap between two consecutive bid sessions

Single and/or block including linked bids :

- Single bids: 15-Minute bids for different price and quantity pairs can be entered through this type of order. Partial execution of the bids entered is possible.

- Block bids: Block Bid for any 15-min block or series of 15-min blocks during the same day can be entered. Although no partial execution is possible i.e. either the entire order will be selected or rejected.

The bids so entered are stored in the central order book. The bids entered can be revised or cancelled till gate closure

Matching Session

- At the end of the bid session, bids for each 15-minute time block are aggregated and matched using double sided closed auction methodology as also pursued in day-ahead market.

- The Area Clearing Price (ACP) and Area Clearing Volume (ACV) are determined for each block of 15 minutes as a function of demand and supply which is common for the selected buyers and sellers.

- Selected participants are intimated about their partially or fully executed bids and other trade related information within 1 time block after closure of auction period.

- Funds availability

- Exchange uses ACP and ACV used to calculate the obligation of the selected participants and their power flow.

- Bid limit shall be in accordance to the funds available in the settlement accounts of the participants.

Financial Settlement

- Pay In / Pay Out (PI/PO) will be done on T/ T+1 date respectively subjected to banking hours and holidays

Result Session

- IEX to intimate Area Clearing Price (ACP) and Area Clearing volume (ACV).

- Exchange to send final results for confirmation and application for scheduling of Collective transactions-RTM to NLDC.

- NLDC sends the details of the schedule to respective RLDCs.

- RLDCs /SLDCs incorporate Collective Transactions-RTM in the Daily schedule.

- A scheduled transaction is considered deemed delivered.

- Deviations from schedules are dealt under UI or Deviation Settlement Regulations or Imbalance Settlement Regulations. The Regional Entities connected at ISTS networks are governed by CERC Regulations and Embedded Entities and entities connected to state transmission or distribution network are governed by respective State Electricity Regulatory Commission’s Regulations.